Tax

We recognize our role as a responsible corporate citizen to pay our fair share of taxes, including corporate income taxes, employment taxes, value-added taxes, sales taxes, excise taxes, property taxes and customs duties.

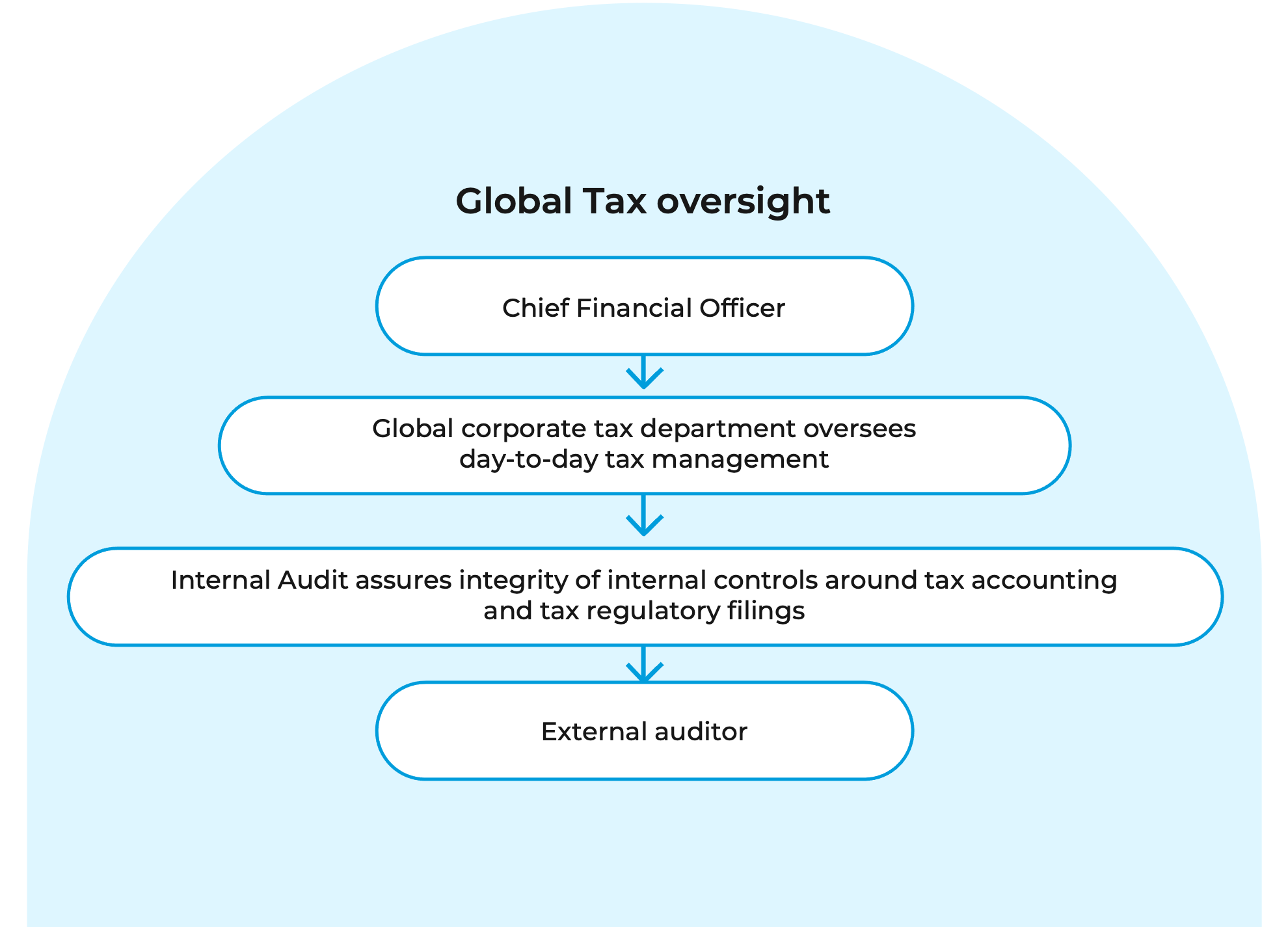

Global tax oversight

Our Chief Financial Officer (CFO) is ultimately responsible for our overall tax position.

The way we conduct business, including the economic impact from the taxes we pay, reflects our commitment to striving to reach those in need with our medicines and devices, and helping to build robust, durable health systems worldwide through partnership, investment and innovation.

Day-to-day tax management is performed by our global corporate tax department, which supplements its own subject matter expertise with advice from third-party subject matter experts. Effective oversight of the tax function is maintained by quarterly tax presentations to the Audit Committee of our Board, and regular meetings with the CFO and other executive leaders to discuss emerging tax matters. The integrity of our internal controls around tax accounting and tax regulatory filings is assured by our internal audit staff and our external auditor.

We seek to comply with tax requirements in every jurisdiction in which we operate and only engage in tax planning that is aligned with our commercial business activities and reputation.

We use the arm’s length standard in transfer pricing and OECD guidelines for international tax matters. We have a zero-tolerance approach to tax evasion and the facilitation of tax evasion. Where uncertainty exists, and when appropriate, we seek clarification from our external advisors or governmental authorities. This may take the form of tax rulings or advanced pricing agreements from governmental authorities.

We monitor proposals and changes to tax incentives and regulations in the countries in which we operate to assess their impact on our business, and we actively participate in industry groups interacting with government representatives to support the development of effective tax systems that encourage innovation and growth.

Learn more about our ESG governance, ethics and compliance, privacy and data security, procurement and supply chain, and public policy and political contributions